Cashaa Mengganggu Industri Remittance

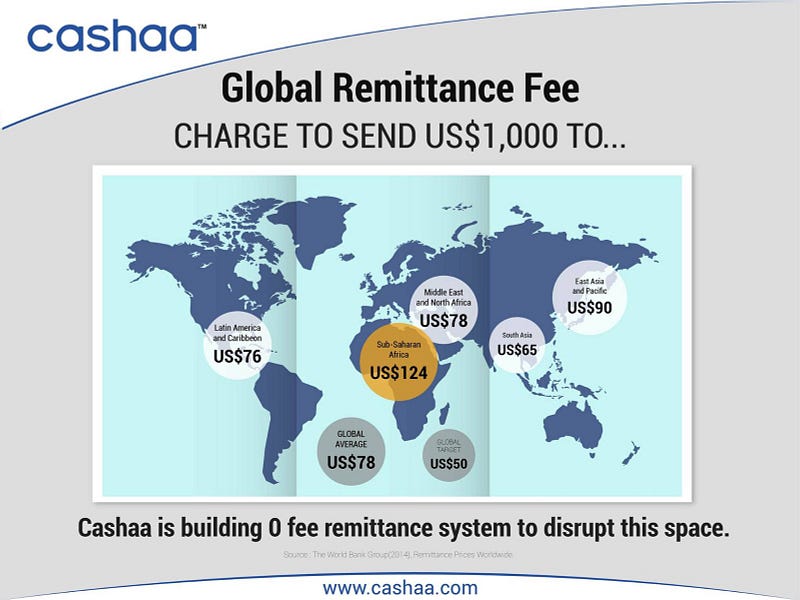

Industri remittance merupakan bagian integral dari negara berkembang dan banyak negara di Asia, Afrika dan Amerika Latin sangat bergantung pada pengiriman uang sebagai bagian dari GDP mereka. Masyarakat di negara-negara ini bertahan dengan uang yang ditransfer dari anggota keluarga mereka setiap bulan dan tanpa pengiriman uang ini, masyarakat ini dapat dengan mudah jatuh ke dalam kemiskinan atau bahkan kelaparan. Berdasarkan data dari The World Bank, pada 2016 saja $ 575 miliar USD dikirim secara global. Industri ini saat ini didominasi oleh bank dan juga beberapa legacy players seperti Western Union dan MoneyGram yang mengenakan biaya yang relatif tinggi (See the Fees Table) serta margin dari nilai tukar valuta asing yang bisa mencapai 6%. Lihat di bawah untuk berapa biaya tinggi bisa pergi.

Dengan meningkatnya globalisasi, semakin banyak orang bekerja di luar negeri di negara-negara yang lebih kuat dan mengirimkan uang kembali ke keluarga mereka dan ini menyebabkan industri pengiriman uang tumbuh lebih besar dan lebih besar. Meskipun demikian, ada juga gerakan pengungsi besar dalam beberapa tahun terakhir dan sekali para pengungsi ini secara ekonomi berkontribusi dalam komunitas baru mereka, mereka juga akan mengirimkan uang kembali ke keluarga yang mereka tinggalkan di negara-negara bekas mereka. Bank Dunia memperkirakan bahwa pengiriman uang diperkirakan mencapai $ 615 miliar pada 2018 dari $ 575 miliar pada tahun 2016.

Cashaa is a startup that intends to disrupt this massive industry by developing a banking solution that can allow faster and cheaper remittance than what is provided by the current players. It will leverage on the fast growing cryptocurrency market to provide the much needed liquidity and will offer a flat fee of $1 for remittances and wholesale foreign currency exchange rate. It will compete directly with the traditional players who have been charging high fees and speed up the transactions.

Traditional players like Western Union and Moneygram relies on themselves as well as the banks to provide the liquidity for remittance to take place. This is the reason for the fees and high margin exchange rates charged by them. But Cashaa will leverage on the liquidity provided by cryptocurrencies traders whole wide to actualize the money transfer. And they will do this in the background seamlessly. The cryptocurrency market is now at $175 billion market cap and is expected to reach 1 trillion dollars in the near future, and will be able to give the liquidity needed for a global remittance industry. This will immediately impact the remittance industry as fees will be lowered and traditional players will be pressured to lower their rates too.

An immediate response by skeptics is why would anyone trust Cashaa to remit their money back home and that most customers will stick to Western Union and Moneygram and the likes. First of all, Cashaa will require the crypto traders to provide escrow for the crypto currencies to be traded; the seller to provide 100% of the coins he is selling while the buyer will provide 10% in the escrow wallet. Moreover what Cashaa is doing is to enable trust with the use of KYC checks which will be compliant with the different guidelines in each country as well as the usage of legally binding smart contracts provided by Agrello Foundation.

We will see a huge disruption in the remittance industry and even smaller players such as money changers and remittance shops can make use of the Cashaa platform to offer cheaper and faster services to their existing clientele. The remittance industry will no longer be dominated by a few players and will become decentralized as peer-to-peer remittance will be powered by blockchain and cryptocurrencies. This will benefit millions who are sending much needed money to their families back home.

Links to Cashaa:

https://cashaa.com/pdf/Cashaa_WP.pdf

penulis : https://bitcointalk.org/index.php?action=profile;u=1348480

my eth : 0x0DE9e43dC9a22d88457c8629d61DEBaBCA3F1446

Komentar

Posting Komentar